Feature phones comeback confirmed by increasing sales numbers

Feature phones, or dumb phones as some call them, are making a comeback these days. The comeback is not just another PR story, but is underpinned by rising sales figures in markets like the US. Sales there are driven primarily by Generation Z and Millennials, who are increasingly seeking a “digital detox” due to mental health concerns related to smartphone and social media use. Counterpoint Research has analysed the trend in the US and provides an overview of the situation here.

Feature phones have seen a revival in the US market as younger consumers, particularly Generation Z and Millennials, express interest in digital detox and a minimalist lifestyle. Hashtags like #bringbackfliphones on platforms like TikTok have contributed to this trend.

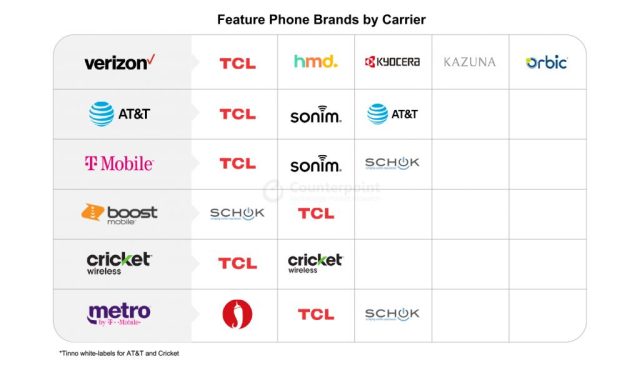

These phones are attractive to consumers because of their relatively low cost, ranging from US$20 to US$100. This affordability has led to more people experimenting with feature phones and sharing their experiences on social media. The increased sales have increased competition in the US market. TCL and HMD are the leading players, but they also face competition from brands such as Schok, Sonim and white-label manufacturers such as Tinno that sign agreements with mobile operators.

Despite the resurgence, feature phones still account for a small share of total mobile phone sales in the US at just over 2%. TCL dominates the market with a 43 % share, followed by HMD with 26 %, while smaller players account for the remaining share.

Can HMD increase its market share in the US?

The reason why HMD is in second place could be the lack of availability of Nokia mobile phones in the portfolio of major network operators such as AT&T, T-Mobile, and others. These network operators are seeking partnerships with various feature phone OEMs, thus intensifying competition among manufacturers. This leads to a diversification of the market. Nokia phones are so far only available on Verizon, and a smart move by HMD managers would be to try to convince other operators to sell Nokia phones. This is a tricky business, usually driven by the massive financial backing of brands, and HMD is no longer a powerful player. This means that HMD will be happy with a second position in the smartphone market, as it still sells a large amount of phones

What brings the future?

The number of feature phones sold is forecast to reach 2.8 million in 2023, with steady sales expected in the near future. Niche demand drivers, affordability, durability, and B2B sales are expected to contribute to continued stability in sales.

To broaden the appeal of mobile phones, new potential features are welcomed. Counterpoint expects some manufacturers to add new hardware configurations such as eSIM and NFC to make these devices more relevant to modern consumers. These additions could improve the functionality and convenience of feature phones.

This is necessary as there is a consumer base that is looking for minimalist devices with relevant features to stay connected in today’s digital world. Feature phones have room for growth if these features are integrated while maintaining usability.

So feature phones are making a slight comeback due to a combination of factors, including consumers’ desire for digital relief, affordability and potential hardware upgrades. These devices continue to have their place in the market because they are suited to specific use cases and consumers prefer simplicity and affordability. One thing I would like to see is support for WhatsApp.

Source Counterpoint